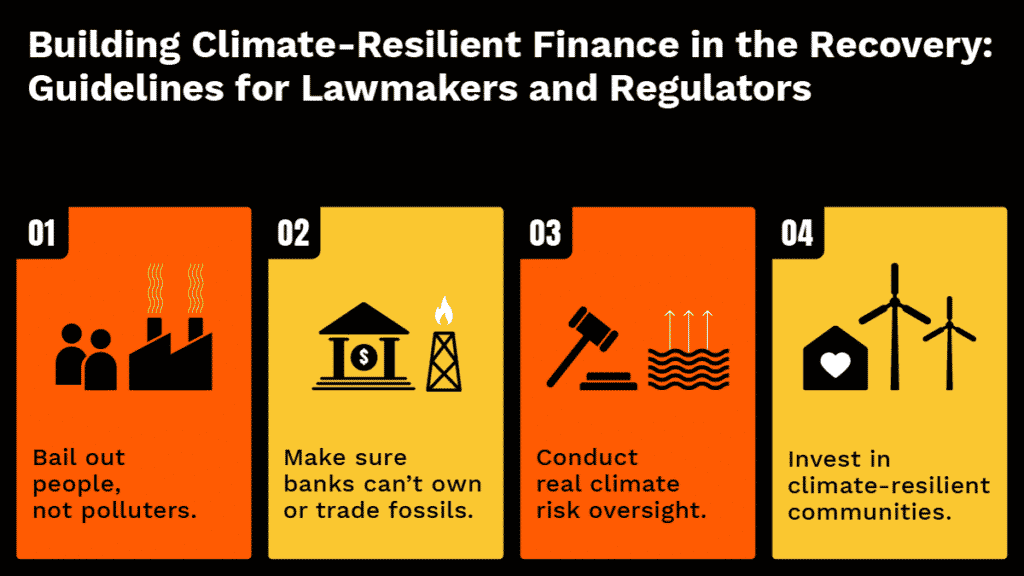

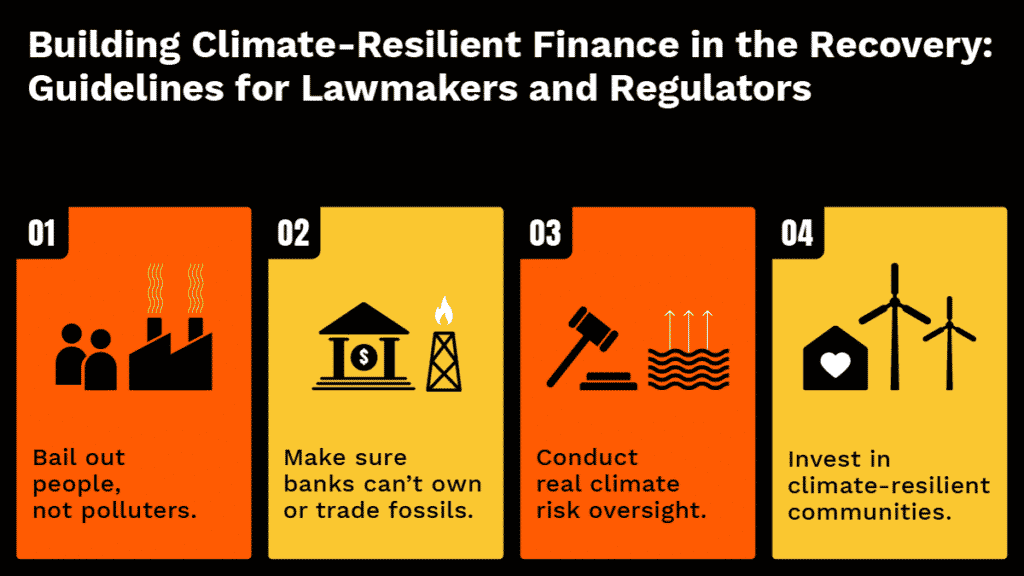

Building Climate-Resilient Finance in the Recovery:

Guidelines for Lawmakers and Regulators

Click here to download these guidelines as a PDF with citations.

The urgent work of recovering from the COVID-19 pandemic must prioritize public health, provide economic relief directly to people, and protect democracy. The federal-level recovery must not bail out the fossil fuel industry or give unchecked power to Wall Street.

Measures taken in the recovery will shape our country’s economy, including our impact on the climate, for the next decade and beyond. The science is clear — we must cut global carbon emissions in half by 2030. What we do in the recovery could make or break that goal.

The steps we take regarding the financial system are crucial. The current crisis has already shown the riskiness of big financial companies placing bets on fossil fuels. In this recovery, we face a clear choice: bail out the fragile, already over-leveraged, fossil financial system and lock in the looming climate crash, or keep building a resilient green financial infrastructure that will serve as a stable foundation going forward.

Lawmakers must resist calls from Wall Street to roll back regulations and instead take clear, decisive actions that require banks, asset managers, insurers, and other financial institutions to phase out support for fossil fuels in order to safeguard the American people and the U.S. financial system from further climate risks. Those actions must include:

Bail out people, not polluters.

The COVID crisis has underlined the fundamental weakness of fossil fuel companies and shown the riskiness of financial institutions’ big bets on fossil fuels. It has also shown the recklessness of the fossil fuel industry, which is advancing construction of new projects despite the risks of COVID-19, and the recklessness of Wall Street in pouring money into these destructive and heavily-indebted companies despite numerous warnings over many years of the fragility of their business model.

The prudent path forward requires banks, asset managers, asset owners and insurers to stop driving the expansion of fossil fuels and deforestation, and commit to zeroing out their involvement with climate-risk sectors. A common-sense guardrail should be: financial companies can’t take public money without committing to phase out their fossil financing, while ensuring a just transition to a zero-carbon economy.

Furthermore, the COVID crisis should not be an excuse for deregulation of fossil finance, nor waivers of existing regulation.

Relatedly, bankruptcy law should be changed so that creditors take their proper place in line: fossil fuel companies entering bankruptcy must pay lifetime benefits to their workers, restore environmental damage, and discharge any other regulatory obligations before resolving other claims.

Make sure banks can’t own or trade fossils.

As fossil fuel companies crater, banks are reportedly maneuvering to take over assets from their most indebted clients outright. Lawmakers should repeal the authority for banks to own physical assets like oil refineries, pipelines, tankers, power plants, and coal mines and trade commodities, or commodity companies that explore, drill, refine, transport, or export fossil fuels, specifically including such fossil fuels as crude oil, fracked gas, and coal.

Conduct real climate risk oversight.

Banks and other financial institutions are reportedly using the crisis as an excuse to shirk common-sense climate risk responsibilities. Regulators should incorporate climate risk into their prudential regulatory and supervisory framework. That includes:

1. Mandating climate risk and impact disclosures and stress testing for financial institutions and the financial system as a whole, as well as issuing regulations to address and mitigate those risks,

2. Lawmakers closing a glaring regulatory loophole by designating large asset managers and insurance companies as systemically important financial institutions, and

3. The Federal Reserve joining, as a full member, the Network on the Greening of the Financial System, an international network of central banks and supervisors working together to address climate risk to national and global financial systems.

Invest in climate-resilient communities.

Lawmakers should establish a climate investment mandate to ensure that financial institutions with a federal charter invest a certain percentage into climate change mitigation, resilience and just transition efforts, with specific prioritization for communities and areas most impacted by environmental racism.