BLOG: Why Costco Should Clean Up Its Citi Credit Card Costco is in a pickle (and we’re not talking about free samples): they’re partnered with Citibank, one of the world’s dirtiest banks. Since 2016, Citi has funneled a staggering $332 billion into new fossil fuel investments. As the third largest retailer in the US, Costco, […]

Category Archives: Blog post

Greetings from New York, where the sky is orange and the air quality index hit a staggering 484 on Wednesday afternoon – nearly 200 points higher than what is considered hazardous for all living beings. The immediate cause of this crisis is wildfires in Canada, the real cause is the climate crisis. New York is […]

If you look at Citi’s marketing and PR, you’d be mistaken for thinking this is a company that cares about the climate crisis and racial equity. Jane Fraser talks a good game about climate commitments and equity, but LEED-certified buildings and diverse models on the website aren’t enough. Citi paints itself as a climate champion, […]

Last week, two Citibank customers and I met with some of Citi’s top Sustainability leadership: Val Smith, the Head of Sustainability, and Nasser Malik, the Corporate Banking Head of Sustainability and Corporate Transitions. Unfortunately, Citi’s leadership are spewing the same talking points we’ve heard for months. It’s becoming more and more clear: Citi’s sustainability team […]

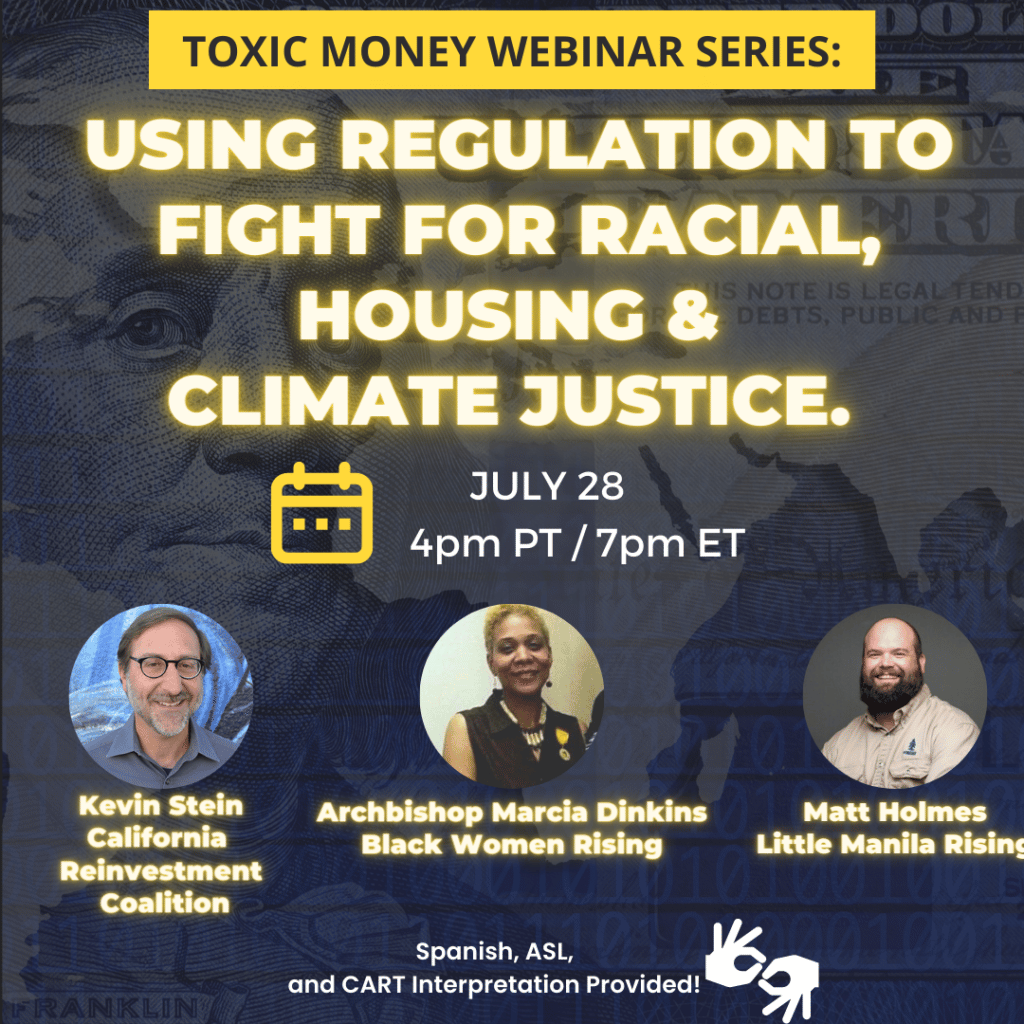

On this webinar, We learned about how the Community Reinvestment Act can be used as a tool to build community solutions, especially as accountability to deal with the legacy of racial and economic harm done to communities via redlining and discrimination. The CRA could fund climate reparations to communities, as well as fund workforce development. […]

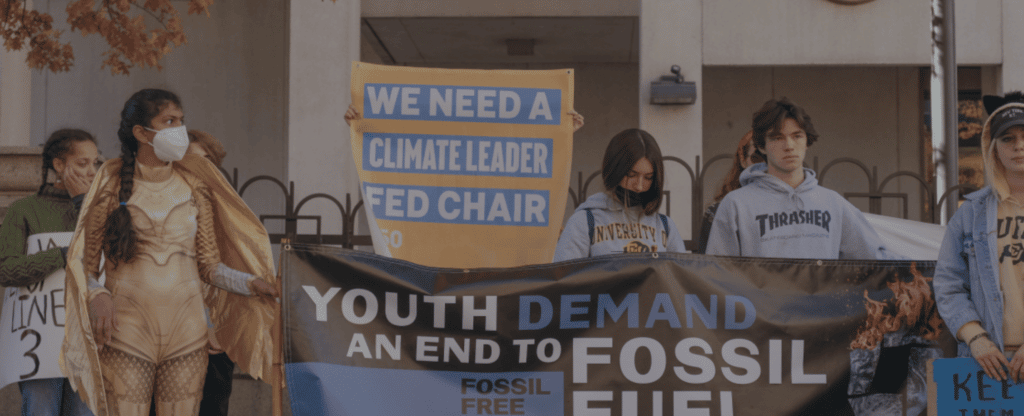

What Biden should have talked about last week with Fed Chair Powell This blog is reposted and originally appeared on 350.org. by Jason Kirkpatrick With inflation and gas prices topping the agenda in the USA recently, one could be surprised by what topics were left out of the recent meeting between President Biden, Treasury Secretary Janet Yellen and Federal Reserve Chair […]

This shareholder season, STMP launched the Wall Street’s Moment of Truth – People or Fossil Fuels campaign to push investors to support climate action at banks and insurance companies. Shareholder, or “AGM” (annual general meeting) season is a period roughly between April and June when publicly-traded companies hold their annual shareholder meetings. At these meetings, […]

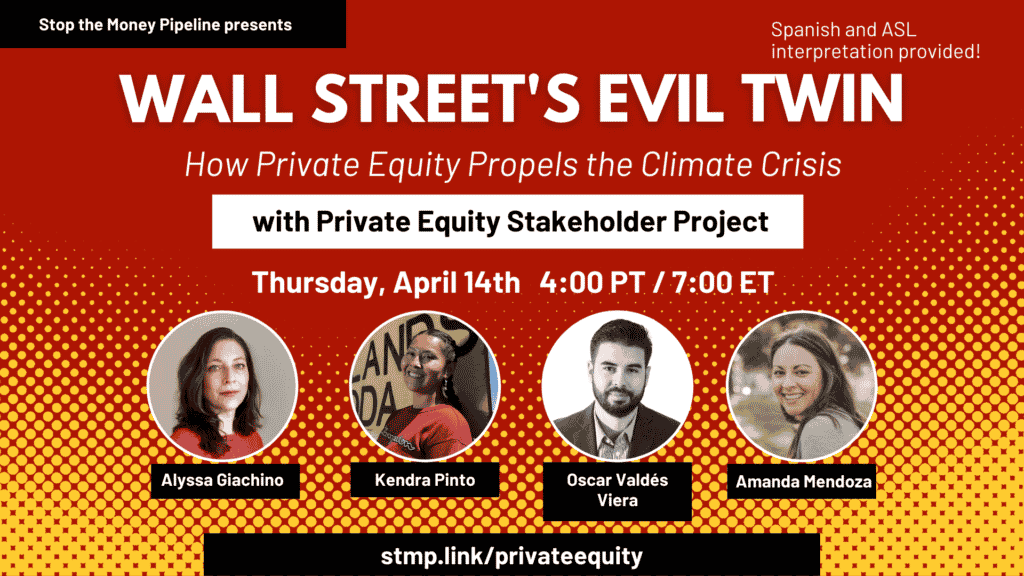

On this webinar, we learned about why we need transparency from companies around their contributions to the climate crisis and how they’re fueling harm in BIPOC communities. Many of us are told that being financially responsible means investing in stocks and bonds and saving for retirement. But if the world goes up in flames, our […]

Did you know that climate change poses a hidden threat to your investments, 401(k) accounts, and pensions? We’re all told that being financially responsible means investing in stocks and bonds, and saving for retirement. Here at Stop the Money Pipeline we also consider saving the planet to be saving for our futures. Unfortunately, if the […]

Have you heard about Wall Street’s evil twin? It’s the private equity (PE) industry and it’s dripping in fossil fuels. As financial institutions and other Wall Street actors face growing pressure to cut emissions, many are selling fossil fuel assets—and PE firms have repeatedly stepped up as buyers. Private equity firms and the billionaires and […]